TikTok didn’t slow down in 2025. It became louder, faster, and even more competitive for consumer apps trying to get noticed. With over 1.59 billion active users worldwide and almost 60% of them being Gen Z, Titok is still the most powerful discovery engine on the planet.

At Social Growth Engineers, we went all in. We tracked and analyzed thousands of videos from consumer apps, app marketers, and indie founders. The trends that sparked downloads, the hooks that made people stop scrolling, the formats that drove engagement, and, most of all, the strategies that ended up leading to the strongest businesses and monthly recurring revenue.

With the year ending, we looked at all our research and turned it into this report. Inside, you’ll find what made certain apps explode, what lessons to take from the best performers, and how to use these insights to shape your 2026 TikTok strategy.

2025 in Numbers: The State of Consumer Apps

Before jumping into the numbers, it’s worth understanding where all this data comes from. Every app we analyzed has been active across multiple short-form platforms and runs a wide network of accounts.

The stats you’ll see represent how these brands showed up mostly organically across the different short-form video platforms, mainly TikTok, Instagram Reels and YouTube Shorts.

Still, TikTok remains the biggest driver of traction and discovery. No surprise there, given how dominant it’s become for consumer apps.

Most aren’t even decade-old giants, but recent apps that managed to stand out.

The Big Picture

Here’s a quick snapshot of how each niche performed overall. These charts show total downloads, revenue, engagement, and views so you can get a clear sense of the broader trends before we move forward.

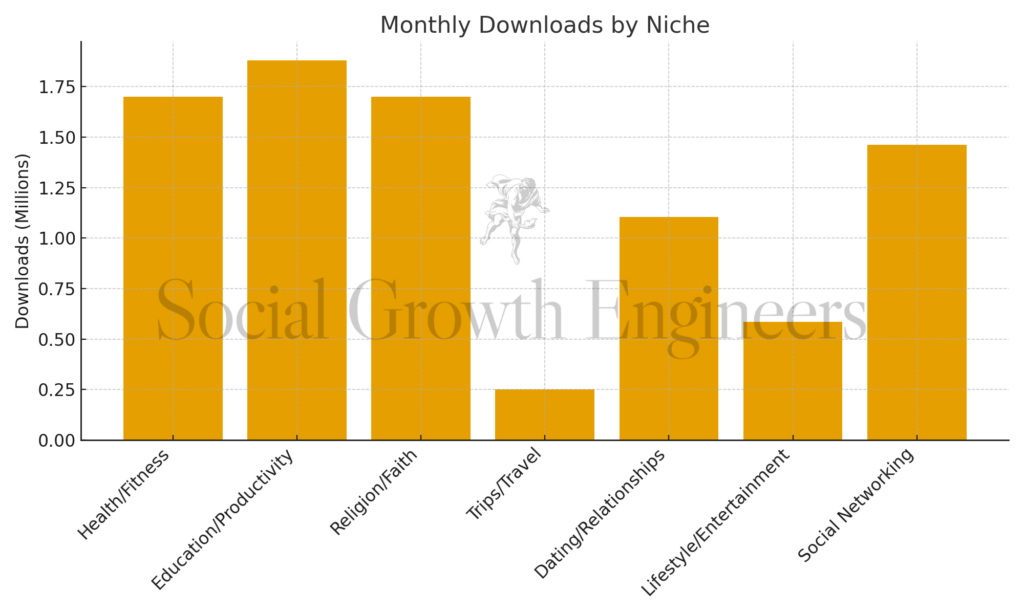

Downloads

This chart highlights which niches attracted the most new users every month.

Education and Productivity took the lead, followed by Health & Fitness, and Religion & Faith. On the other end, Trips & Travel saw comparatively lower downloads, reflecting a slower pace of new user acquisition.

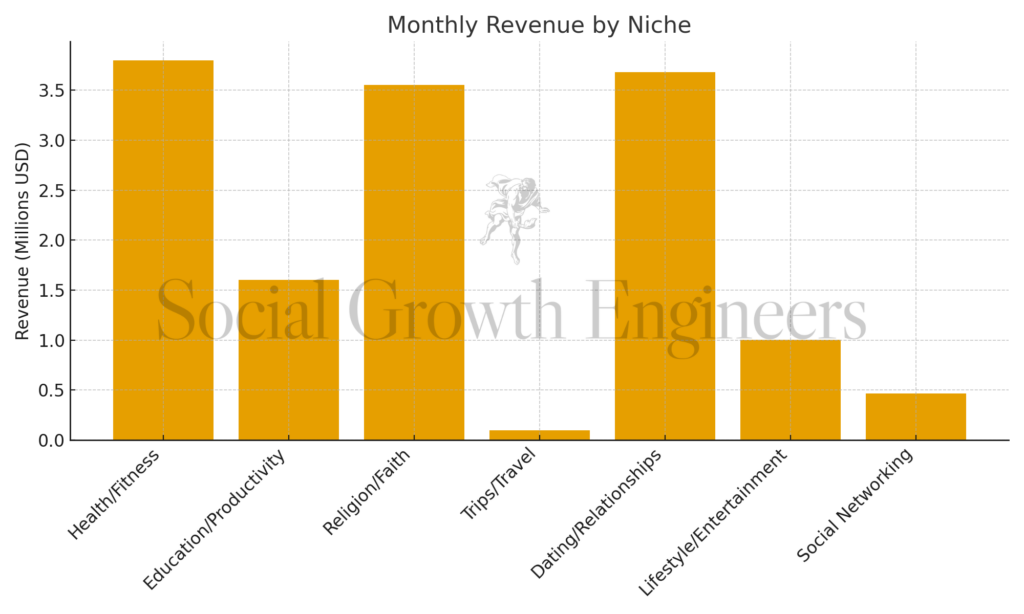

Revenue

Here you’ll see how much revenue each niche generated.

Health & Fitness topped the charts, with Dating & Relationships close behind. Religion & Faith rounded out the top three, making these the most profitable niches overall.

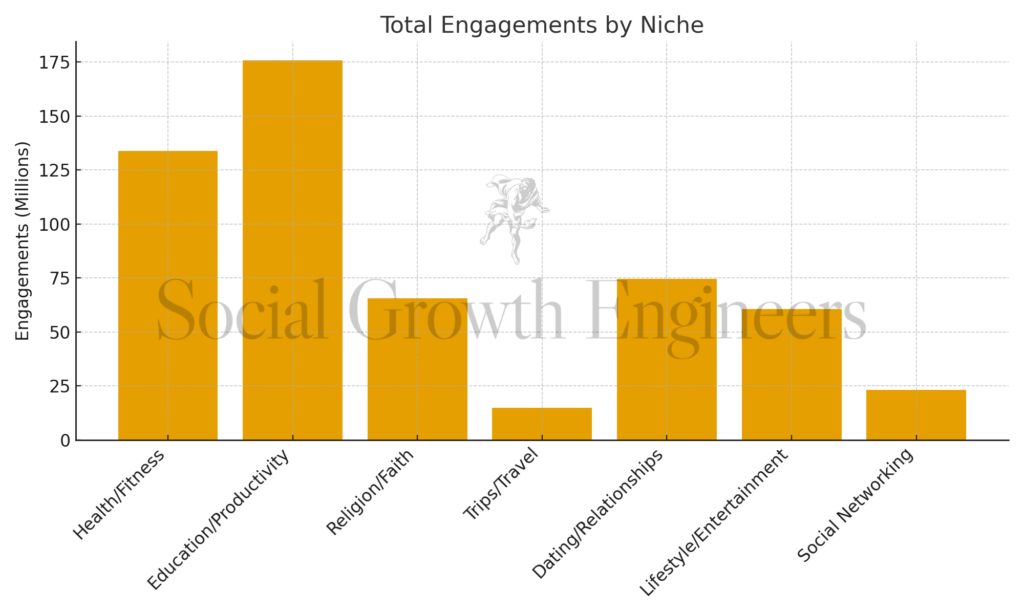

Engagement

This graph highlights which niches sparked the most audience engagement, based on likes, comments, shares, and bookmarks.

Education & Productivity led in total engagement, followed closely by Health & Fitness. These niches excelled at keeping viewers saving, commenting, and sharing.

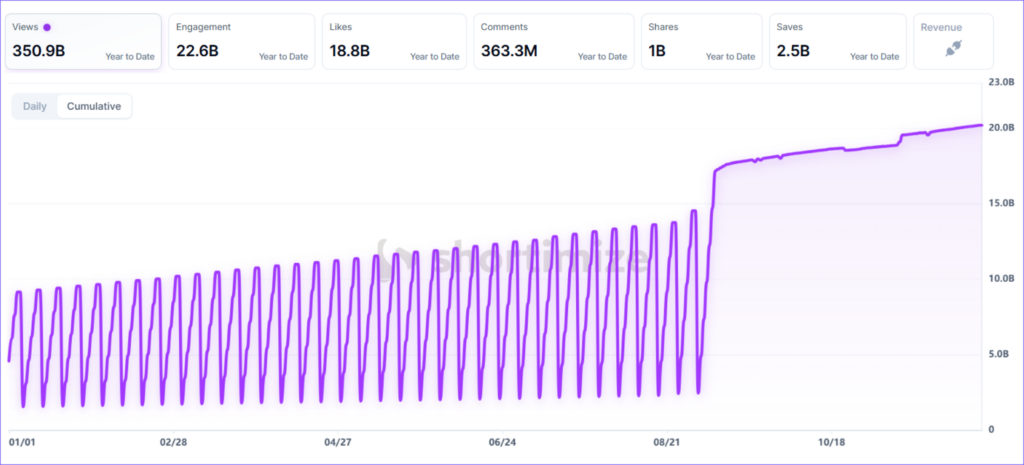

Views

Last but not least, this final chart compares the overall views volume.

Health & Fitness generated the highest number of views, with Education & Productivity taking second place.

Which Format Worked Best?

After analyzing thousands of top-performing videos across all niches, one thing was clear: faceless content had a slight overall edge.

On average, faceless videos reached 1.5M views, while face-led videos averaged 1.3M. The gap isn’t huge, but it’s consistent.

Across the board, faceless videos also delivered stronger engagement per 1,000 views.

This suggests two things:

- Viewers find faceless formats easier to consume and share.

- They blend more naturally into the For You feed, where quick, low-friction storytelling wins.

This aligns with broader platform behavior: simple formats like slideshows, B-roll + text overlays, avatar-led videos, screen recordings, and story-based edits scale faster. Mostly because they’re easy to produce, easy to test, and easy to replicate.

On this note, don’t forget to check out the 50 faceless formats guide we launched earlier this year, packed with fifty format ideas, plus all the prompts on how to recreate them.

What Video Length Worked Best?

When we broke down performance by duration, one pattern stood out:

Medium-length videos (20–40 seconds) are the clear winners.

On average, these videos pulled in 2M views, with a strong 4.06% engagement rate, outperforming both short snappy clips and long-form storytime content.

Short videos (under 10 seconds) still spiked in some niches when paired with punchy hooks, whereas long videos worked well for emotional formats, but overall, medium length was the most reliable, scalable duration across consumer apps.

Overall, founders and marketers are mastering the art of “people-first content”, creating stories their audience can actually relate to and see themselves in.

Let’s break it down niche by niche.

Health, Fitness and Well-Being

This niche saw a fresh wave of creativity in 2025. Below, you’ll find a set of standout apps, mostly emerging players and bootstrapped teams, and what drove their organic visibility and traction.

Top Performers

Fit With Coco

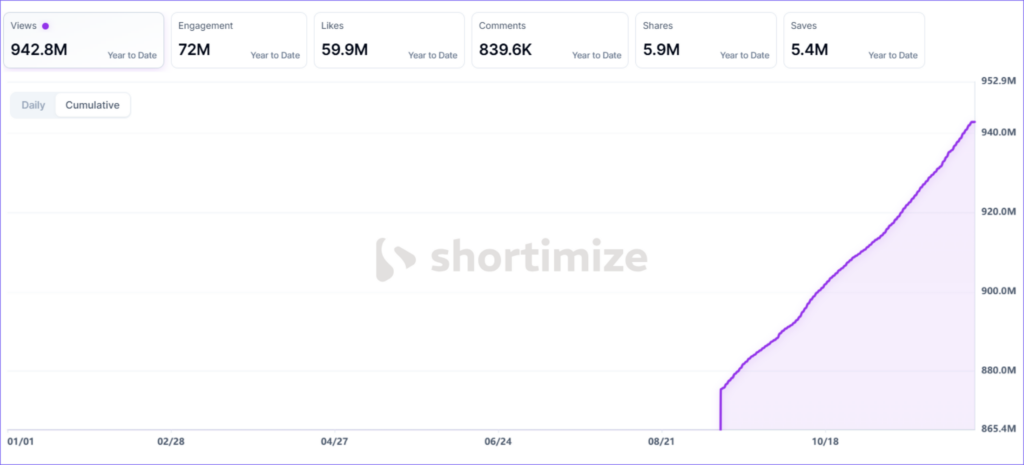

Fit With Coco, a founder-led account, turned fitness coaching into a full-on viral movement. With nearly 950 million views and 16.7 million in engagement, Coco proved that consistency really does pay off.

She posted every single day, four times a day for over three years, sometimes hitting ten posts daily. Her short, motivating videos with hooks like “Workout with me” or “Obsessed with strength training” kept people coming back for more. Her mix of discipline, energy, and authenticity made Fit With Coco one of the biggest organic success stories of the year.

Check out the full breakdown here and explore the complete Fit with Coco collection.

Cal AI – Calorie Tracker

Cal AI – Calorie Tracker became one of the year’s top data-driven fitness apps, earning $2 million monthly with 600K downloads. By now, it’s fair to say that Cal AI could be the leading AI scanner app in this niche.

Its 14.2 million views came from a mix of faceless and on-camera creators and branded accounts, showing real, everyday use and making healthy choices look effortless.

Check out the full breakdown here and explore the complete Cal AI collection.

Musa Period App

With 292.3 million views and 15.1 million in engagement just this year, Musa built a genuine movement around body positivity and menstrual health.

Mixing faceless formats, like sign-holding videos, with creator-led content featuring bold hooks such as “10 years of using male-designed apps”, Musa kept its message real and relatable.

Check out the full breakdown here and explore the complete Musa Period App collection.

Liftoff & Tone AI

These two apps nailed the formula for high-energy, transformation-style TikToks. Together, they pulled in more than 820 million views, with Liftoff hitting 396 million and Tone AI reaching 426.2 million.

Liftoff focused on clips highlighting real app usage, mostly using a short hook, while Tone AI mixed things up with slideshows, workout videos, and A/B-style comparisons.

Both leaned into quick, comparison-style storytelling packed with gym visuals that made fitness feel competitive and fun.

Their creative blend of formats turned gym routines into viral, visually charged moments.

Check out the full breakdown here and explore the complete Tone AI + Liftoff collections.

Copia (Now Era)

Copia (now Era) started as a manifestation app but quickly grew into something bigger: a full stress-and sleep-tracking brand built on calm, connection, and creativity. Recently, it went through a huge rebranding and is now fully targeting the mental health niche, with new features such as breathwork and emotional management.

With 46.2 million views, it may not top the charts, but its strong engagement shows a deeply loyal niche audience. The founder, who now runs multiple creator accounts, turned her brand into a growing creator network.

Mixing ASMR-style visuals, face-led videos, and slideshow formats, she built a soothing yet scalable presence that perfectly captures the softer side of the wellness space.

Check out the full breakdown here and explore the complete Copia collection.

ReciMe

ReciMe became the go-to spot for quick, aesthetic meal ideas, pulling 113.2 million views, $1 million in monthly revenue, and 700K downloads.

With faceless formats, catchy short hooks, and visually satisfying cooking videos, ReciMe turned simple recipes into high-engagement content that everyone wanted to save, share and try.

Check out the complete ReciMe collection.

Innertune Affirmations

Innertune Affirmations was one of 2025’s surprise viral hits, racking up 156.3 million views and getting 22.9 million people to hit like, share, or comment.

Its faceless videos, eye-catching thumbnails, and short, snappy hooks turned daily affirmations into instantly scroll-stopping and highly shareable content.

Check out the full breakdown here and explore the complete Innertune Affirmations collection.

5D Waves, Death Clock AI, and Cal Scan

These smaller apps proved that even modest-budget teams can generate massive organic reach. Despite lower revenue and downloads, each app hit multi-million view counts:

Death Clock AI grabbed 7.6 million views by repurposing famous podcasts into cropped, concept-driven videos that went viral for their shock factor.

Check out the full breakdown here and explore the complete Death Clock AI collection.

5D Waves leaned on illustrations, remaining entirely faceless, and reached 7.6 million views.

Check out the full breakdown here and explore the complete 5D Waves collection.

Meanwhile, Cal Scan kept it simple, using neat food comparisons to show the app in action, all without showing faces, demonstrating that clever, focused content can punch well above its weight.

Check out the full breakdown here and explore the complete Cal Scan collection.

Education & Productivity

2025 was a year of fierce competition in this space, with countless new players trying to grab Gen Z’s attention.

The content strategies were diverse. Some apps leaned into humor and memes, while others doubled down on creator-led storytelling or faceless, data-driven content. What united them all was one thing: a clear understanding that TikTok is where Gen Z learns, laughs, and levels up.

Top Performers

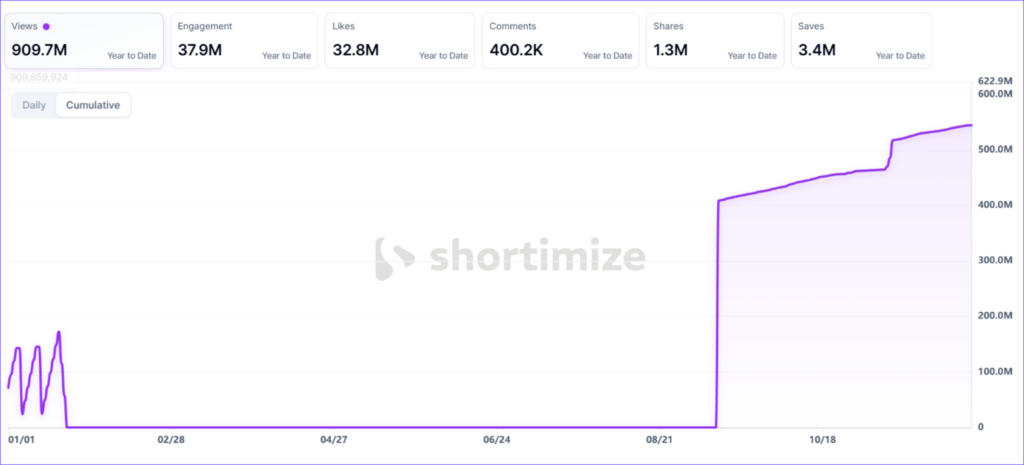

Fluently

Fluently led the charge, pulling in nearly $200k in monthly revenue with 90k monthly downloads.

Their TikTok network hit almost 1 billion views and over 44 million engagements by mixing educational and meme-style content that felt native to the platform.

Check out the full breakdown here and explore the complete Fluently collection.

Turbo Learn

Turbo Learn followed closely with $400k in monthly revenue and 300k monthly downloads.

Their viral hooks like “My Harvard professor showed me this” became a format in itself, replicated across hundreds of ambassador accounts. The combination of intellectual curiosity and trend-driven edits gave their content a massive organic push.

Check out the full breakdown here, their hook data set, and explore the complete Turbo Learn collection.

StudyFetch

StudyFetch stood out for its ambassador network, a massive web of creators operating across TikTok and Instagram.

Together, they drove 547.5 million views and 39 million engagements, helping the brand maintain consistent visibility.

Check out the full breakdown here and explore the complete StudyFetch collection.

Knowunity: AI Study Tutor

Knowunity is another fascinating case. With a global content strategy that included region-specific creators and localized content, they reached 253.9 million views and 30 million engagements.

Their approach proves that personalization isn’t just about AI, but about understanding culture, language, and how students actually consume content in different parts of the world.

Check out the full breakdown here and explore the complete Knowunity collection.

Brainly

Brainly, a more established name, made a solid comeback by rethinking its hooks and formats.

Their shock-and-surprise approach (“Wait, you didn’t know this?”) helped them maintain steady traction, with 37.7 million views and 3.4 million engagements.

Check out the full breakdown here and explore the complete Brainly collection.

Studley AI and Raena AI

This year, both of these apps doubled down on ambassador-heavy strategies.

Studley AI built a massive army of nearly 100 accounts, relying on sheer posting volume and consistent content spin-offs to dominate the “StudyTok” space.

Check out the full breakdown here and explore the complete Studley collection.

On the other hand, Raena AI tapped into affiliate and ambassador programs to drive 44.8 million views and 5.6 million engagements, proving smaller apps can compete with reach when the network effect is strong.

Check out the full breakdown here and explore the complete Raena collection.

Lingo Looper

Lingo Looper experimented creatively, using avatars, gamified storytelling, and conversational hooks to attract their Gen Z audience.

They’re making $40K in monthly revenue and pulling over 50M views, all driven by a tight creator network, including some accounts that grew so fast that they became full-on micro influencers in the niche, built from scratch.

Check out the full breakdown here and explore the complete Lingo Looper collection.

Focus Flight

Lastly, Focus Flight found its edge through community-led virality. Their branded hashtag challenge, #focusflightchallenge, invited users to create their own spin on productivity clips.

Helping the app gain 18.2 million views and 1.8 million engagements, mostly from user-generated content.

Check out the full breakdown here and explore the complete Focus Flight collection.

Religion and Faith

Besides an already huge stock of existing apps, more apps have entered the market.

The whole ChristianTok wave is basically running the show on short-form content right now. Their hooks hit you in the feels, the stories feel extremely personal, and, as a result, the audience always responds.

Top Performers

Bible Chat: Daily Devotional

With over $2 million in monthly revenue and 1 million monthly downloads, Bible Chat is one of the most successful apps in this niche.

This year, their short-form marketing efforts generated 55.4 million views and 4.7 million engagements across platforms. The key was a forever growing creator network, paired with a main account that kept experimenting with diverse formats.

Their biggest strength is using short, punchy hooks that catch viewers’ attention as they scroll, especially with a Gen Z audience.

Check out the full breakdown here and explore the complete Bible Chat collection.

Hallow: Prayer & Meditation

Hallow app followed closely, bringing in $800k in monthly revenue and 200k downloads. Their content strategy blended faceful and faceless clips, often in collaboration with massive ChristianTok creators. It’s a different kind of short-form marketing, one that relies on a large budget that allowed them to execute several strategic partnerships over the year that were almost guaranteed to go viral.

Their videos pulled 84.3 million views and 3.9 million engagements.

Check out the full breakdown here and explore the complete Hallow: Prayer & Meditation collection.

PRAY

The PRAY app adopted a more old-school style: a faceless approach, short and strong hooks, and a consistent rhythm of posting.

It brought in 163.7 million views and 15.5 million engagements, translating into $200k in monthly revenue.

Check out the full breakdown here and explore the complete PRAY collection.

Prayer Project

Prayer Project is fully founder-led.

The creator speaks directly to the camera, and that direct connection earned them 44.7 million views and an insane 37.7 million engagements, with 36.3 million likes alone.

Despite the huge traction, this app struggled to turn its content into a profitable business, with a general lack of conversion-optimized hooks and formats.

Check out the full breakdown here and explore the complete Prayer Project collection.

Pray Screen Time – Bible Focus

Pray Screen Time took a clever angle by mixing faith with productivity.

Their concept, “Pray to unlock your apps,” instantly clicked with Gen Z, resulting in 17.9 million views and 566.5k engagements.

Check out the full breakdown here and explore the complete Pray Screen Time – Bible Focus collection.

Bible Mode: Reduce Screen Time

Bible Mode used a similar playbook but scaled it harder. They built a significant network of over two dozen accounts, running faceless, repeatable content formats.

With 7.5 million views and 1.8 million engagements, they’re now making $30K monthly revenue.

Check out the full breakdown here and explore the complete Bible Mode: Reduce Screen Time collection.

Prayer Lock: Christian Focus

Prayer Lock also leaned on faceless visuals, using gym-app-style transitions and clean, fade-in reveals.

That simple yet consistent structure generated 14.5 million views and 598.3k engagements, proving even minimal storytelling works when the message is clear.

Check out the full breakdown here and explore the complete Prayer Lock: Christian Focus collection.

Faithy: Devotional & Prayer

Faithy took risks that paid off.

They built a wide ambassador network, testing multiple content styles at once, hitting 4.7 million views, 358.3k engagements, and $6k in monthly revenue.

Check out the full breakdown here and explore the complete Faithy: Devotional & Prayer collection.

Haven and Manna

Haven leaned heavily on mass slideshow schemes, a strategy that’s quickly becoming a go-to for faith-based apps. With $400k in monthly revenue, they pulled in 2.2 million views.

Manna used the same approach and saw even bigger traction, hitting 28.7 million views and 569k engagements.

Check out the full breakdown here and here, and explore the complete Haven: Bible Chat and Manna: Daily Bible Study collection.

Travel

Despite being the niche with the weaker results, the players in this space still managed to grow and pull a decent outcome, both in terms of views and in revenue/donwloads.

Travel is less crowded than religion or study apps right now, which means there’s real room to carve out a breakout moment.

We pulled together a full collection of hooks from the top-performing TravelTok apps and their reels. Check out the Hooks Collection here.

Top Performers

Trip BFF

One of the strongest players in the niche right now, Trip BFF is doing $50k in monthly revenue with 20k+ monthly downloads.

Their marketing strategy pulled in 93.5M views, 5.9M engagements, 5.7M likes, 14.5k comments, 23.6k shares, and 121.9k bookmarks. They’re running a huge ambassador network, constantly testing long and short hooks, and mixing slideshows with short videos.

Check out the full breakdown here and explore the complete Trip BFF collection.

Going Solo: Travel Friends

A smaller but fast-rising contender. Sitting at $7k in monthly revenue and 5k+ monthly downloads, their content has earned 68.2M views, 4.3M engagements, 4.2M likes, 5.6k comments, 13.9k shares, and 78.8k bookmarks.

Their approach mirrors Trip BFF, but with an aesthetic twist paired with versatile hook variations.

Check out the full breakdown here and explore the complete Going Solo: Travel Friends collection.

Nomadtable

A cool breakout from the indie side. They’re making $30k per month and pulling 200k+ downloads consistently. Their strategy has generated 20.5M views, 585.9k engagements, 410.9k likes, 6.8k comments, 35.2k shares, and 133.1k bookmarks.

What’s interesting is that the founder is leading the charge through his own content, supported by a small but focused creator network.

Check out the full breakdown here and explore the complete Nomadtable collection.

Tryp.com

Currently at $5k monthly revenue with 20k+ downloads, their strategy performed with 39.5M views, 4.2M engagements, 2.5M likes, 14.2k comments, 754.4k shares, and 964.6k bookmarks.

Their edge is multilingual UGC: their ambassador network posts in multiple languages, with heavy traction coming from Europe.

Check out the full breakdown here and explore the complete Tryp.com collection.

FlySafe

Another rising indie app in the space, bringing in $7k per month and 5k+ monthly downloads. Their creative output delivered 3.8M views, 215.8k engagements, 158.8k likes, 768 comments, 19.4k shares, and 36.9k bookmarks.

The app name is always visible in their posts, and they even comment “FlySafe” to boost recognition. Recently, they’ve been testing with slideshows as well.

Check out the full breakdown here and explore the complete FlySafe collection.

Dating and Relationships

Dating and relationships had one of the most explosive years. Tons of new apps entered the niche, and the top performers made serious money.

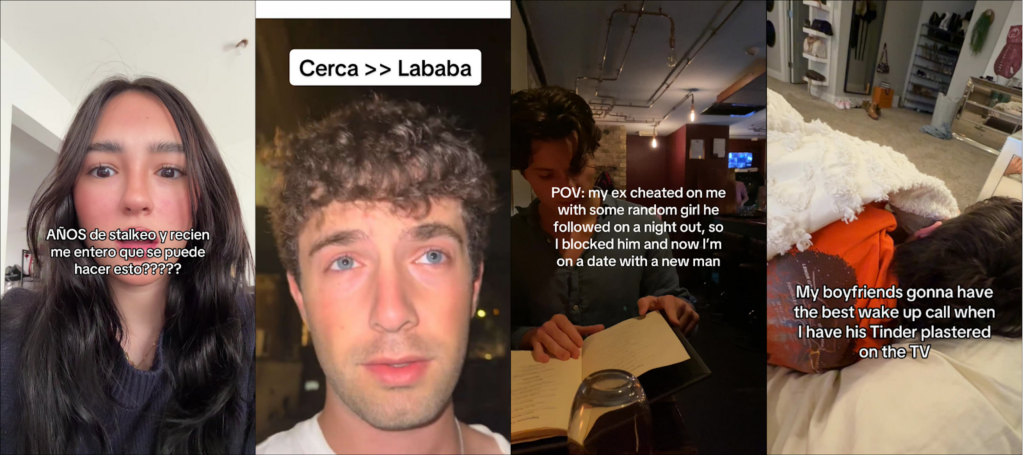

This category has always been spicy and internet-friendly, and TikTok only amplified that. All the way from controversial hooks to emotional storytelling and toxic ex-baiting, this niche knows how to get people watching, commenting, and downloading.

In fact, they’re so good at it that creators from completely different niches started borrowing them just to boost their own views.

We pulled together a full collection of hooks from the top-performing CoupleTok apps and their reels. Check out the Hooks Collection here.

Top Performers

Hily Dating App: Meet. Date.

A giant in the space, doing $3M per month with 200k+ downloads.

They’ve leaned fully into attractive on-camera creators delivering short hooks in short videos. This formula pulled in 48.6M views, 957.3k engagements, 880.4k likes, 14.3k comments, 27.4k shares, and 36.1k bookmarks.

Check out the complete Hily Dating App collection.

Couple Joy – Relationship App

One of the strongest players in the entire category. Pulling $300k monthly revenue with 400k+ monthly downloads, they’ve built a massive faceless empire powered by slideshows and punchy hooks like Spicy Questions.

Their network has generated 231M views, 25.6M engagements, 18.9M likes, 48.8k comments, 3.7M shares, and 3M bookmarks.

Check out the full breakdown here, their hooks data set, and explore the complete Couple Joy collection.

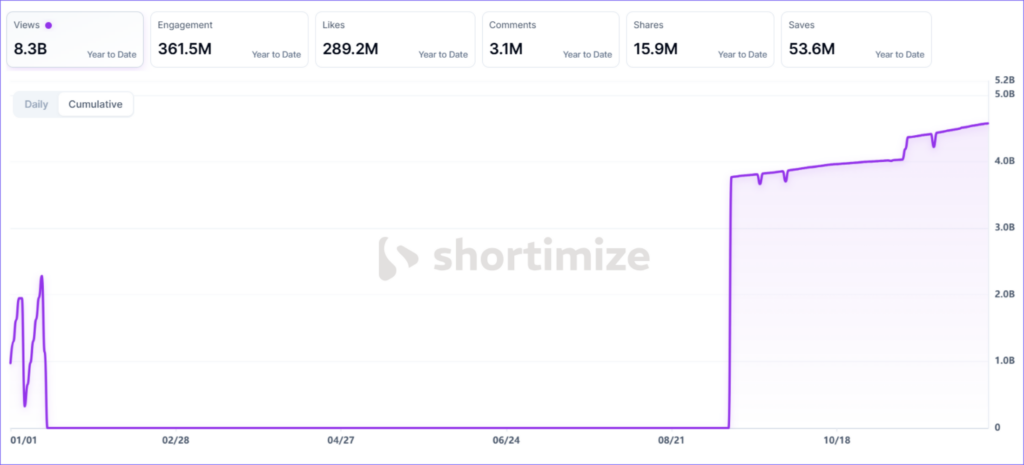

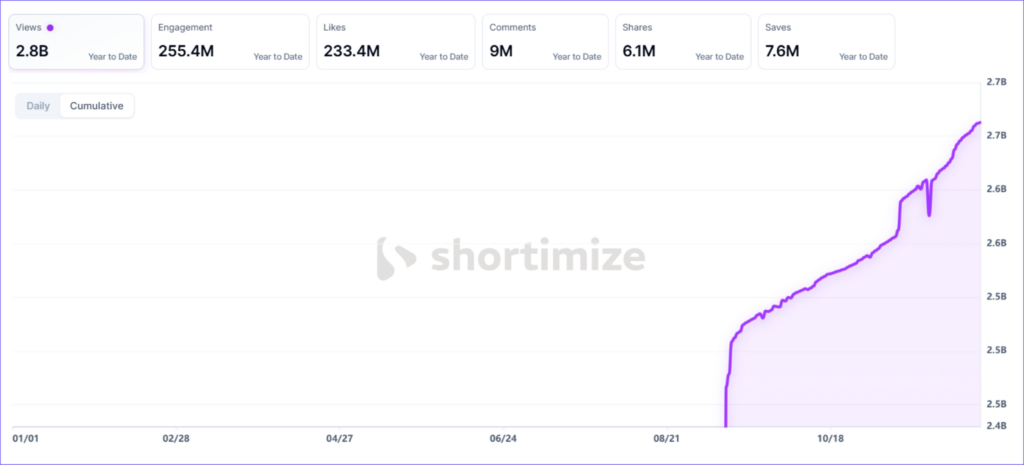

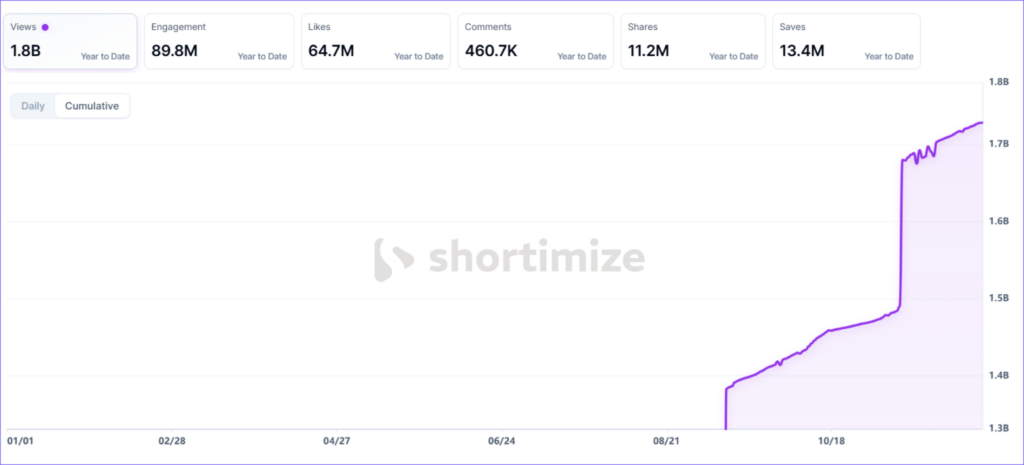

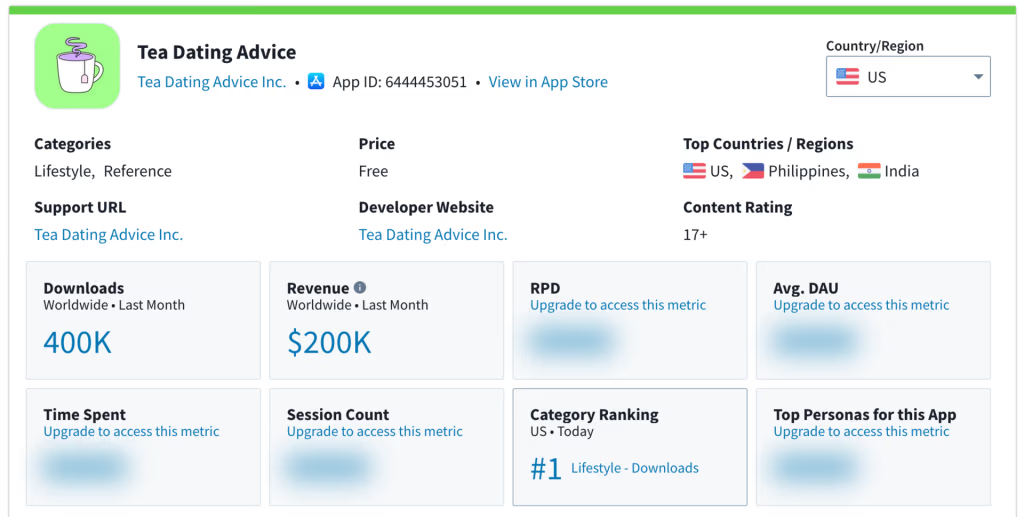

Tea Dating Advice

Before Tea was removed from the App Store, they were doing $200k per month with 400k+ downloads, backed by a wild content engine powered by fictional stories on cheating, breakups, scandals, and dating felons.

Their network drove 290M views, 12.5M engagements, 11.4M likes, 160k comments, 518.5k shares, and 388.9k bookmarks.

Their storytelling style influenced half the niche.

Check out the full breakdown here and explore the complete Tea Dating Advice collection.

Lox Club – Jewish Dating App

What started as a joke app became a real business, thanks to consistently viral distribution across TikTok and Instagram.

Their big win came from a Zoom-meeting skit that exploded and defined their tone. They’ve racked up 53.8M views, 5.4M engagements, 4.8M likes, 25.5k comments, 314.7k shares, and 242.9k bookmarks and are currently making $100k monthly revenue with 5k+ downloads.

Check out the full breakdown here and explore the complete Lox Club collection.

Ghosted: No Filter Dating App

Positioned strongly in Europe, making $60k per month with 30k+ downloads, most of their content is in French, mixing music-driven face videos with short, effective hooks.

Their content pulled 101.3M views, 4.2M engagements, 3.6M likes, 17.1k comments, 446.5k shares, and 153.9k bookmarks.

Check out the complete Ghosted collection.

Ember – AI Relationship Coach (Formerly Us Couples App)

A smaller but promising AI-driven entry. Doing $7k monthly revenue with 10k+ downloads, and posting 45M views, 1.1M engagements, and 1M likes.

They’re scaling through a wide ambassador network, mostly using simple chest-up headshot videos that feel intimate and personal.

Check out the full breakdown here and explore the complete Ember collection.

Cray Cray

A couple’s game app released last year, it is now pulling $10k per month with 30k+ downloads.

Cray Cray runs one of the biggest faceless creator networks we’ve ever seen in consumer apps, with hooks like “5 uncomfortable questions to ask your other half” that hit consistently. Their reach: 255.8M views, 22.8M engagements, 10.6M likes, 54.7k comments, 4.8M shares, and 7.3M bookmarks.

Check out the full breakdown here and explore the complete Cray Cray collection.

Zest Couples: Games & Quizzes

Currently doing $5k monthly revenue with 30k+ downloads, their content output generated 38.6M views, 965.7k engagements, 796.7k likes, 2.9k comments, 71.8k shares, and 95.2k bookmarks.

Zest Couples run faceless formats featuring cartoon couples with short hooks and face-based content featuring longer hooks and personal storytelling.

Check out the complete Zest Couples collection.

Lifestyle and Entertainment

The audience in this niche is naturally hyper-engaged. They love aesthetics, storytelling, identity-driven content, and anything that feels fun, expressive, or a little chaotic. If you’re targeting young users who love discovering “their next obsession,” this is the playground to build in.

Top Performers

Character AI: Chat, Talk, Text

A monster performer doing $600k monthly revenue with 400k+ monthly downloads, their content engine has produced 121.6M views, 13.3M engagements, and 10.7M likes.

They cross-post the exact same videos on TikTok and Instagram, mixing faceless formats with strong hooks like AI-generated people, celebrity edits, Ghibli filters, and clean screen recordings. Character AI essentially mastered the “same video, two platforms, infinite reach” system.

Check out the full breakdown here and explore the complete Character AI collection.

Dippy – AI Characters & Roleplay

Currently pulling $10k monthly revenue with 6k+ downloads, their distribution strategy is massive. They run over 80 accounts, making it one of the biggest faceless networks we’ve studied.

Their content has hit 88.7M views, 3.8M engagements, and 3.2M likes. Dippy’s bread and butter: A/B comparison videos at scale.

Check out the full breakdown here and explore the complete Dippy AI collection.

Starcrossed

Doing $60k monthly revenue with 5k+ downloads, this is a founder-led success story. Her simple, talking-to-camera astrology content built an audience before the product even launched.

That consistency paid off: 113.9M views, 9.1M engagements, and 7M likes.

Check out the full breakdown here and explore the complete Starcrossed collection.

Eyepic: Eye Color Camera

Eyepic is doing $20k in monthly revenue with 10k+ downloads, backed by one killer format: street interviews. Scan a stranger’s eyes → show the app in action → instant curiosity.

This alone generated 195.4M views, 4.7M engagements, and 4.2M likes.

Check out the full breakdown here and explore the complete Eyepic collection.

Rizz

Making $200k in monthly revenue with 90k+ downloads, Rizz’s faceless B-roll TikTok strategy is wild: long videos (2–5 minutes), tons of accounts, and story-driven text overlays.

Their creators insert the app name or a product screenshot inside the narrative, and together they’ve pulled 43.1M views, 2.6M engagements, and 2.2M likes.

Check out the full breakdown here and explore the complete Rizz collection.

POV – Disposable Camera Events

They run a multi-account, faceless TikTok machine, and recently started testing an AI avatar narrator for a more face-forward feel.

Their numbers: 87.1M views, 6.7M engagements, and 5.2M likes, resulting in $100k monthly revenue with 50k+ downloads.

Check out the full breakdown here and explore the complete POV Camera collection.

Astroscope: Astrology Guide

One of the biggest view-generators in the niche, they’re currently doing $9k monthly revenue with 5k+ downloads.

Built entirely on faceless zodiac slideshows, heavy text, emotional topics, and global scaling across six new accounts, Astroscope pulled 467.8M views, 18.4M engagements, and 14.9M likes.

Check out the full breakdown here and explore the complete Astroscope collection.

Closetly

In this past year, Closetly expanded from one account to multiple ambassadors, going full on with storytelling content. Every video revolves around a scenario: a crush, a night out, a moment, but in the end, it always circles back to the outfit.

That angle generated 40.9M views, 2M engagements, 1.7M likes, 4.8k comments, 112.4k shares, and 116.7k bookmarks, leading to $5k in monthly revenue with 20k+ downloads.

Check out the full breakdown here and explore the complete Closetly collection.

Social Networking

Social apps stand out when they tap into relatable, emotion-filled narratives. Most top performers relied on two pillars: raw UGC and tight emotional context, both of which feel organic on TikTok and Instagram.

Top Performers

Partiful

Partiful pulled in $5k monthly revenue with 300k+ monthly downloads. Their content has driven 84.1M views this year with 6.5M engagements. Almost everything is organic, boosted by a wide ambassador network.

Their two winning formats are extremely simple: close-up selfie UGC and faceless invites, both designed to feel like friends sending you event plans.

Check out the full breakdown here and explore the complete Partiful collection.

Locket

Locket’s entire strategy is built around small creators posting the exact same video format: a face shot paired with a quick app demo, hitting 161.8M views and pulling $300k in monthly revenue and 800k+ monthly downloads.

Check out the full breakdown here, hook data set and explore the complete Locket collection.

Daze — Freeform Chat

Backed by 14.8M views, Daze is making $5k in monthly revenue and 20k+ monthly downloads.

Every piece of their content is 100% faceless, following a repeatable blueprint: a screen-recorded text convo layered on b-roll.

Check out the full breakdown here and explore the complete Daze collection.

Ditto — Your Life in Lists

Ditto is earning $5k in monthly revenue with 5k+ monthly downloads, having generated 22.8M views this year.

Their vibe is “iPhone Notes meets Pinterest”. Think clean layouts, cozy pace, and founder-led stories (repeated over and over with slight tweaks each time).

Check out the full breakdown here and explore the complete Ditto collection.

Pengu — Virtual AI Pets

Pengu brings in $100k in monthly revenue and 300k+ monthly downloads, fueled by 51.8M views.

Their strategy is multi-format, multi-account, and powered by a giant penguin mascot (Duolingo energy).

Check out the full breakdown here and explore the complete Pengu collection.

SUSH — Virtual Pet Grow & Evolve

SUSH generates $10k in monthly revenue with 30k+ monthly downloads, backed by 1M views.

Their ambassador network is huge. Most creators are students, which is why the content feels native to Gen-Z rather than branded.

Check out the full breakdown here and explore the complete SUSH collection.

Status — Sim but Social Media

Status playbook is pure founder content: simple videos with a text hook, reposted across multiple accounts with slight edits for each audience.

They reached 48.8M views, which led to $40k in monthly revenue with 6k+ monthly downloads.

Check out the full breakdown here and explore the complete Status collection.

Finance and Investments

The finance niche is full of potential, both for not being as crowded as giants like Education, Health, or Religion, and for the current gap it exposes: most apps struggle to push past low MRR.

It often comes down to weak distribution, low trust, clunky UX/UI, or content that doesn’t translate into $$$.

Still, the apps that do break into five figures prove that the niche has room for breakout winners.

Top Performers

PayMe – Claim Your Money

The standout of the entire category. PayMe is pulling in $300K MRR with 300K monthly downloads, easily making it the dominant player. Their content engine delivered 26.6M views and 2.3M in engagement.

Their strategy is based on long-hook face-overlay videos paired with variations of talking-style content.

Check out the full breakdown here and explore the complete PayMe collection.

Budget Bestie

Budget Bestie sits at $50K MRR and 100K monthly downloads, largely fueled by the massive virality behind its signature format. Their strategy has generated 131.4M views and 6.9M likes, comments, and shares.

They took the already-popular “cash stuffing” trend and turned it into a faceless carousel system, a repeatable format that punched way above its weight.

Check out the full breakdown here and explore the complete Budget Bestie collection.

Profit AI

Sitting at $20K MRR and 10K downloads, Profit AI has generated 13.7M views and 526.2K in engagement.

They optimized their content for conversion, using a selective format testing that squeezed more downloads out of fewer views, a rare skill in this niche.

Check out the full breakdown here and explore the complete Profit AIcollection.

Peek – AI Personal Finance App

Peek is below $5K MRR and under 5K downloads, but their distribution engine is massive: 39.4M views and 3M engagements.

They’re pushing UGC at scale through dozens of accounts, but the conversion gap is wide. Lots of content, very little revenue, suggesting issues in onboarding, positioning, or trust.

Check out the full breakdown here and explore the complete Peek collection.

Chart AI

Also below $5K MRR and under 5K downloads, Chart AI has still racked up 135.8M views and 3.1M likes, comments, and shares.

Their behind-the-scenes + close-up format hits, but it’s not new, and the monetization struggles show that views ≠ revenue without a strong in-app value curve.

Check out the full breakdown here and explore the complete Chart AI collection.

Autopilot – Investment App

Autopilot is under $5K monthly recurring revenue, but hits 70K downloads, backed by 87.5M views and 4.2M in engagement.

They’ve tapped into the “inform and convert” loop, even if the revenue hasn’t caught up. Their comment section is also a key part of the strategy: they reply to everything.

Check out the full breakdown here and explore the complete Autopilot collection.

How Top-Performing Hooks Drove Growth Across Each Niche

Hooks are the engine behind every viral moment. They decide how fast someone stops scrolling, how long they stick around, and how much they connect with an app’s story.

Across niches, the top-performing apps were using hooks that lined up with their audience’s mindset and emotions.

Below, you’ll find the breakdown of the hook patterns that consistently drove views, conversions, and downloads in each niche. These insights come from the top videos we selected after reviewing thousands of posts across TikTok and Instagram.

Health, Fitness and Well-being

In this niche, hook performance was surprisingly broad, with no single pattern dominating, proof that creators have a lot of flexibility here.

Still, “How to” and lightly contrarian openings pulled ahead, especially when paired with short, punchy phrasing.

And while most hook characteristics performed well, formats built around direct questions or list-style opens consistently underperformed.

Education and Productivity

The hooks leaned heavily towards one clear winner: comparison. Formats like ‘my GPA before vs. after,’ ‘what I used to do vs. what I do now,’ and the classic ‘why didn’t I find this sooner?’ dominated across top-performing videos, contributing to the niche’s 493.3M total views.

Curiosity and fear were the strongest emotional angles, consistently pulling viewers deeper into the content. Both short and medium-length hooks performed well, giving creators room to play with pacing.

Question-based hooks, along with opens starting with “You” or “I,” proved far more effective than other characteristics. Interestingly, the breakout opening phrase of the niche was “My Harvard,” which repeatedly showed up at the top of high-performing videos.

Religion and Faith

In the Religion and Faith niche, “How-to” hooks were the clear standout, driving a big portion of the niche’s 142.3M total views. The emotional angles that performed best were curiosity and hope, two themes that naturally fit faith-based content.

Bible study topics dominated the top videos, showing just how strong the demand is for simple, practical spiritual guidance. Medium-length hooks delivered the best results, giving creators enough space to build interest without overwhelming viewers.

Travel

Testimonial-style hooks, where creators speak from personal experience, sharing their own routines, mistakes, or tips, dominated, driving 401.9M total views. Think lines like: ‘I wish I had friends to travel with,’ ‘Here’s what I learned traveling solo,’ or ‘If you’re flying soon, you need this.’

Travel stories need a bit more of a setup and more room to build context, so long hooks performed naturally well in this niche.

The strongest hook characteristics were questions and openings that used “you” or “I,” which made the content feel more personal and conversational. Hostel-related opening phrases consistently rose to the top, suggesting that budget travel and backpacking themes resonated most with the audience.

Dating and Relationships

The Dating and Relationships niche crossed 568M total views, with the standout pattern being the ‘Warning’-style hooks. Creators leaned into storytime formats, sharing their own dating flops, shocking first dates, and personal red-flag checklists, which fitted perfectly with TikTok’s desire for drama.

This mix of warnings + personal stories made the content feel both entertaining and relatable, which is why it consistently pulled strong view counts.

Testimonial and Storytime hooks were close behind, which makes sense for a niche built on personal experiences and emotional stakes. Longer hooks outperformed short and medium ones, giving creators more space to build tension, set context, and pull viewers into the story.

Lifestyle and Entertainment

The Lifestyle and Entertainment niche amassed 622.7M total views, with testimonial hooks emerging as the top-performing pattern.

Both medium and short-length hooks drove the most engagement, and, unlike some other niches, the list format performed particularly well here.

It’s easy to understand why. People, especially Gen Z, are obsessed with comparing their lives online and optimizing every single aspect of it to the point of living becoming an aesthetics battle: anything you do, others can do it prettier (and post about it).

Lists are perfect to deliver compact advice plus it’s the best format to trigger saves, as viewers are too scared of missing out on that one tip that will forever fix all their problems.

Social Networking

Curiosity-based hooks dominated the landscape, driving a big share of the niche’s 287.1M total views. A lot of this momentum came from social FOMO. People (especially Gen-Z) don’t want to feel out of the loop, so when creators teased ‘things no one tells you,’ or ‘the trick everyone’s trying.’ they payed attention.

Targeting primarily Gen-Z and their social circles, medium-length hooks proved the most effective, closely followed by longer hooks. This allowed creators to build intrigue and encourage interactions, while still keeping content engaging and relatable.

Finance and Investments

This niche leaned heavily toward crypto-focused hooks, with most top-performing videos speaking directly to traders and younger audiences looking to invest or level up their financial literacy.

Short hooks pulled slightly stronger results than medium or long formats, and like many data-driven niches, faceless content consistently outperformed face-led videos, especially in driving curiosity and quick retention.

How Apps Scaled Through TikTok Organic Loops

The highest-growth apps of 2025 combined UGC, creator collaborations, trend-driven storytelling, and active brand accounts to trigger conversations and push viewers toward installs.

Across niches, the Content → Conversation → Install loop became the backbone of sustainable organic TikTok growth.

Apps that mastered it shared four common behaviors:

UGC as the Primary Discovery Engine

User-generated content remained the fastest way to reach new audiences. Nearly every successful app we studied relied on a UGC network to grow and scale.

In the travel social networking space, TripBFF launched 30+ UGC accounts since January, reaching over 475.5M lifetime views and ending the year with $60K monthly recurring revenue and 40K monthly downloads.

The study app behind the famous “What’s ur GPA !?” format, Turbo AI, is running a 100+ ambassador program spread across TikTok and Instagram. Over the past year, they grew to over 4,000,000 users and are generating $300k in monthly recurring revenue with 200K monthly downloads.

Locket, the Nikita Bier–backed social app, doubled its creator network during the first trimester of the year, with each account posting 3 times a day. Ruthless optimization (underperforming creators get replaced after only a few dozen videos) and perfect on-screen talent took them to 800k monthly downloads and $300K monthly recurring revenue.

The demand is so high that a wave of new UGC gig platforms keeps popping up, such as Home from College, Payper and Noise, to name a few, with the latter sitting currently at #5 in Business on the App Store, with 40K monthly downloads.

Alongside it, AI-generated influencers and content creators’ agencies aren’t rare anymore, but it’s still too early to know if they can really compete with real people in the world of UGC. So far, only a few have gone viral, and those moments usually don’t last, being more like one-time hits than long-term success.

Telling vs Selling

We always hear that emotions sell better than words, but what does that really mean on TikTok? By the end of 2025, people will have watched so many short-form videos that it will have created a kind of emotional numbness. It’s harder to impress anyone now. Just look at how much controversial or shocking content gets barely any views.

That’s why the smartest consumer apps focus on emotion first. They tell a strong story and make you feel something, while their call to action is just a small detail you might notice after. Their content feels natural and real, and that’s exactly what gets people to react.

StudyFetch, the gamified study app, is one of the most recognizable apps on StudyTok precisely for its risky, almost meme-like, strategy. Having just crossed 1.2B lifetime views, they’re behind the original non-AI angry professor skit.

Stalking apps like Cerca Dating, Follow Spy, The Ick, Cheaterbuster, and Lululoyal are great at playing the storytelling game, driving millions of views and high engagement with (mostly long) hooks that speak of cheating, following exes on social media, and relationship drama.

Curiosity and status are the main emotional triggers behind the learning app Deepstash, which is currently at 200K monthly downloads and $200K monthly recurring revenue. They mostly lean on founder-led content and POV hooks like “You’re getting to smart to fast” and “The TikTok for smart people” to reach their audience and convert viewers into users.

Bird Buddy, a 100K monthly downloads Bird Watching App, created stories and characters – like Larry – around breeds and other niche-deep content, getting much higher results than traditional bird lovers’ content.

These approaches created an ongoing conversation in the comments, which extended reach and conversion far longer than typical marketing posts.

Community Storytelling Unlocked Repeat Viewers

Apps that encouraged users to share their experiences, progress updates, testimonials, confessions, “how I use this daily,” created a content flywheel.

Toca Boca World, the sandbox/creative game, might just be the queen of community-led content, rivaled only by Incredibox. There are thousands of user accounts, mostly teens, posting daily creative content from the game and interacting with each other’s posts, generating a huge community and heavy (natural) engagement.

OCSN built a parallel-universe social network for all fictional characters. Their TikTok strategy is powered by a founder account and two UGC, which is more than enough to take them to 100K monthly downloads since they have dozens of TikTok accounts naturally posting about the app in their targeted audience’s core niche.

CHAI, the social AI chat platform, barely needs a growth marketing strategy or even to run accounts. With their first-mover advantage, tons of unsponsored accounts are organically posting videos about them.

Emy BFF has just launched a completely new organic campaign in November. They created separate accounts and started a series where they throw their mascot down a building (“1mm per follower”). In just five videos, they reached 750K followers and over 50M views. But they didn’t stop there, and after a mysterious countdown on their website, they’ve released their first challenge: three prizes of $600, $300 and $100 to the three best memes their viewers can create for Emy.

Getting organic shares isn’t easy, as you need serious scale before people start promoting your app for free. Still, with the right growth hacks, you can help make that happen. And when you get it right, users start creating content on their own and spreading your app’s name across TikTok. One thing 2025 made clear: people trust other people more than they trust brands. Don’t underestimate the power of a positive customer experience (or a negative one).

Creator Collaborations Added Scale and Niche-Specific Authority

Rather than partnering with one-off influencers, top apps built small ambassador networks or “creator clusters” of aligned creators who posted frequently in their niche. This created mini-echo chambers, where viewers saw the same app across multiple content styles.

Some apps have taken this to a whole new level and worked their way up to create micro-influencers from scratch. Instead of paying absurd amounts to established creators, they invested time and money in “creating” their own.

One of these apps was Lingo Looper, an avatar AI gamified language app. At the beginning of the year, they started setting up a small network of UGC creators. In just 100 days, they pulled over 12 million views. They kept doubling down on the strategy, creating more and more accounts, and now they sit at $40K monthly recurring revenue.

Trends That Drove Growth

Below is a breakdown of the core formats that drove repeatable, scalable growth across consumer apps in 2025, and why they worked.

Emotional Storytelling → Community Trust

Apps that leaned into emotional arcs, vulnerability, personal wins, setbacks, “I’m crying” narratives, built stronger trust at a faster pace.

As social boundaries fade, gentle emotional appeals just don’t cut it anymore. People are filming themselves crying in the car, giving birth in hospitals, or catching their partners cheating… so in 2025, the more intense the scene, the better your chances of success.

TikTok’s algorithm heavily favors retention, and emotional stories keep users watching till the end because they trigger curiosity and empathy. This made people not only stay longer but also comment, share, and tag friends, which pushed videos into larger recommendation pools.

For niches like health, religion, dating, and productivity, emotional framing acted as a credibility engine.

POV & Relatable Chaos → Authenticity-Driven Engagement

POV storytelling (“POV: You finally start taking your health seriously”, “POV: Your team uses our app for the first time”) humanized apps and made them feel like part of users’ real lives.

Mixed with “relatable chaos”, messy rooms, hectic routines, and honest frustrations, these formats removed the polished brand façade.

The raw, unpredictable feel led to stronger engagement because users believed the creator, not the brand. This authenticity boost was especially powerful for Gen Z–dominant niches.

While many turn to social media for aspirational content, there’s no denying the comfort they feel when they find someone who makes them feel normal again. Sharing flaws, opening up about failures, and being honest about personal struggles builds a connection that’s tough to match. It all comes down to how you tell the story, and, more importantly, how you tie it back to your app as the solution.

Slideshow Is the New UGC

In 2025, we realized that almost any viral format could be turned into a slideshow — at half the cost of video production. No need for a UGC creator, filming setup, gear, or even a video editor.

This shift was especially clear with classic UGC content. Instead of full videos, many apps started using repurposed cover images (often straight from Pinterest), paired with 4–5 simple slides.

Before/after shots, habit trackers, chat screenshots, app UI previews, timelines… it all worked, as long as the hook grabbed attention. These slideshows naturally loop because users swipe back, zoom in, and rewatch, which boosts retention in the eyes of the algorithm. They’re also super shareable and easy to bookmark.

For apps in Education, Productivity, Fitness, and even Dating, slideshow-style posts acted like mini case studies that spread quickly in group chats and communities.

“Day in the Life” Creators → Product Lifestyle Positioning

Instead of talking about features, creators embedded apps into their daily routines: “planning my day with X,” “tracking meals with X,” “organizing my study flow using X.”

This format moved apps from “tools” to “habits.” It demonstrated real use cases and solved a major friction point: users’ understanding how the app fits into their routines.

Lifestyle placement drove strong downstream conversions as viewers didn’t see the content as marketing; they saw it as a lived experience.

Dating and Cheating Formats → Sparking Curiosity and Engagement

No niche uses curiosity loops better than dating and relationships. Storytimes, cheating reveals, text message breakdowns, red flag confessions, and “what would you do?” moments all led to huge spikes in watch time.

These formats tap into powerful emotions like shock, suspense, betrayal, and spark heavy comment sections, which the algorithm loves.

This year, apps in totally different niches started using the same emotional hooks and saw view counts skyrocket. Even loosely related setups worked, such as someone checking their partner’s phone and spotting a random app notification.

At the end of the day, nothing pulls people in like gossip, even when they don’t know the parties involved.

AI-Generated Pranks

As AI tools and apps went mainstream, it was only a matter of time before they became the stars of viral content.

By 2025, we moved past low-effort AI content and started seeing smarter, funnier ways to use these tools, especially in comedy.

Two formats stood out and will likely keep growing next year:

- AI-powered pranks played on other people, like “pranking my mom by saying I let a homeless guy stay in the house.”

- Pranking the AI itself, like setting up two chatbots to argue on a call and recording the chaos.

We’re not sure where this trend is heading or how strong the conversion potential really is, but one thing’s clear: AI comedy isn’t fading anytime soon. As these tools become more accessible, only the most creative ideas will break through.

The Lecture Hall Effect

It all began with the “hot professor” trend a few months back. Educational apps started posting staged lecture scenes with a young, attractive professor that led into a call-to-action for their study app.

Soon after, it shifted into “angry professor” skits, first acted out by real people, then quickly recreated with AI tools like Sora.

No matter which version you prefer, one thing is clear: audiences love the sense of peeking behind closed doors and getting a glimpse into someone else’s private world.

It will be interesting to see how this psychological phenomenon translates into new formats as different niches pick up on its power.

Apps That Got Removed in 2025

(And What Founders Can Learn From Them)

n this past year, a handful of apps were taken down, paused, or temporarily restricted for everything from privacy slip-ups to risky UGC.

Tea & TeaOnHer

These two viral dating/safety apps were removed after repeated issues with privacy, weak moderation, and a major content leak that exposed thousands of user images. The complaints piled up fast, and Apple stepped in.

What went wrong:

- UGC moderation was way too loose, a violation of Rule 1.2.

- Sensitive user data wasn’t handled securely, which goes against Rule 5.1.2.

- High-risk content stayed up for too long.

- No strong review or flagging system to catch violations early.

How founders can avoid this:

- Build a basic moderation workflow from day one (even if it’s scrappy).

- Add automated filters: image checks, profanity filters, age detection.

- Audit your data storage and treat user photos like financial data.

- Have a crisis plan if something leaks (most teams don’t).

- Do regular guideline checkups instead of waiting for Apple’s email.

ICEBlock

ICEBlock, an app that tracked law enforcement activity, was taken down due safety and legal risks. Apple’s guidelines are very clear: if an app can be used to facilitate harm or interfere with public safety, it’s out.

What went wrong:

- High-risk real-time location data.

- Use case could easily lead to misuse.

- Violated Apple’s “physical harm” and “illegal behavior” policies.

How founders can avoid this:

- Run a “misuse audit” before launching new features.

- If your app deals with location data, triple-check compliance.

- When in doubt, assume the riskiest user is going to use your product.

- Don’t ship sensitive features without a legal review (even a quick one).

ByteDance-Owned Apps (TikTok, CapCut, Lemon8, U.S. market only)

These apps were temporarily removed early in 2025 due to U.S. regulatory pressure, but the ban was lifted later, and all major ByteDance apps are now back in the App Store. This wasn’t a guideline issue, it was straight-up geopolitics.

What went wrong:

- Sudden regulatory pressure in one market.

- No early-warning signals for founders relying heavily on U.S. distribution.

- Political risk affected product availability overnight.

How founders can avoid this:

- Don’t rely on a single market for your growth engine.

- Build region-specific risk profiles, even if they feel “edge case”.

- Keep an eye on regulatory and data laws (especially for AI + UGC apps).

- Plan for multi-platform resilience (iOS + Android + web fallback).

Zooming Out: The App Store Climate in 2025

Apple delisted tens of thousands of apps this year, many not because they were “bad”, but because they were outdated, non-compliant, or sloppy with privacy updates.

Actionable lessons for founders:

- Treat compliance like a growth lever, not a chore.

- Build lightweight moderation early.

- Keep data minimal (don’t collect things you can’t protect).

- Do monthly App Store guideline checkups.

- If you use UGC, assume Apple is watching more closely.

- Be transparent with users.

- Have a PR and crisis plan before you need one.

- Don’t wait for a removal notice to fix obvious issues.

Lessons from 2025’s Organic Growth

If there’s one thing 2025 proved, it’s that TikTok rewards teams that treat content like a product, fast iterations, rapid learning loops, and systems that scale.

When we analyzed the top-performing apps across every niche, a few patterns repeatedly showed up:

What Actually Worked

- Building a scalable creator engine (UGC + ambassadors)

A wider creator bench means:

- More daily content outflow

- More angles, voices, and narratives

- Faster discovery of winning hooks and formats

- Zero dependency on one creator or one account

Apps like Trip BFF, Dippy AI, and Locket showed this clearly: the network scales the reach, not the branded account alone.

2. “Fail fast, learn fast” testing loops

No time was wasted waiting for perfect creativity. Instead, top apps tested hooks, formats, and durations aggressively, sometimes dozens of variations per week. The winning loop looked like this:

Idea → Test → Read Signals → Double Down on Outliers → Scale

Teams using plug-and-play datasets of proven hooks/formats had a major advantage. By skipping the guesswork and iterating on frameworks that were already validated across the niche, they saw results faster.

3. Consistency as the real growth lever

Across the board, the most successful breakout apps posted daily, sometimes for months, before their product even launched.

Consistency compounds:

- Algorithms trust steady signals

- Creators get better at storytelling

- Audiences develop familiarity

- Hooks and formats get refined through repetition (faster)

It beats “perfect content” every day.

4. Content that feels like something

When it comes to conversion, the strongest-performing content wasn’t always the most viral, it was the most connected to the audience’s wants, needs, and fears.

- Psychological triggers

- Emotional value

- Relatable moments

- Niche-specific insights

- Conversation drivers

Were the key to turning a viewer into a user.

What Didn’t Work

- Blind trend-hopping

Jumping on every trend diluted identity, confused viewers, and wasted resources. The apps that struggled the most kept trying to “go viral” instead of building a loop that made sense for their niche.

2. Violating user trust

Privacy violations, whether accidental or intentional, ruined momentum for several apps. Consumers and algorithms both punish this instantly.

3. Not scaling beyond a single creator or format

Many apps have proved that it’s better to scale – accounts, creators, formats – than rely on one single account to do the heavy lifting. Without a structured ambassador or UGC network, content velocity drops, and so does growth.

4. Playing it too safe with hooks

The best hook frameworks in 2025 were discovered because creators experimented with tension, curiosity, controversy, intimacy, and emotional angles that others avoided.

And those were the ones getting copied across apps and niches.

The Road to 2026: Predictions for Organic Growth

Everything we saw in 2025 points to algorithms rewarding stronger engagement loops and clearer storytelling. With that in mind, here’s what to expect next year.

Algorithm Shifts: What to Expect

Organic reach will keep rewarding retention and real engagement. Watch time, rewatches, comments, and saves will stay the main signals.

Platforms want content that sparks conversations and keeps people watching, so formats that drive rewatches, replies, and shares will keep getting pushed.

Discovery will also lean harder into niche topics and small creator clusters. Apps that build networks of aligned micro-creators (instead of relying on one big name) will win, since the algorithm prefers steady signals from lots of accounts over random spikes.

You can also expect more friction around manipulated or synthetic media. Platforms and regulators are cracking down on deepfakes and non-consensual AI content, so anything using someone’s likeness without clear disclosure is going to face tighter moderation.

Emerging Formats &Hooks

AI-assisted UGC is about to become the new normal. Generative tools will help teams pump out localized versions and test faster, but they’ll still need clear guardrails and real creator consent.

Micro-trend storytelling will take over. Short, fast-moving narratives, serial testimonials, cliffhanger-style tutorials, and progressive reveal slideshows will beat one-off memes. These trends move quickly, so you need a fast test-and-scale system to keep up.

Slideshows, screenshot storytelling, and text-first faceless formats will keep winning because they’re cheap, repeatable, and easy to A/B at scale. When structured well, they drive strong retention and rewatches.

Controversial hooks will still get reach, but with more brand and regulatory risk. Use them lightly, test everything, and avoid anything manipulative that could get flagged or removed.

Category Predictions

Education & Productivity:

Huge engagement and downloads already, and it’s not going anywhere anytime soon. In this busy fast-paced world, everyone wants to learn and do things faster and more easily.

Health, Fitness & Well-Being:

Routines, progress stories, and habit content keep this space consistently viral. Especially with the constant new trends around these topics.

Dating & Relationships:

Drama, confessions, and storytime hooks keep this category loud and monetizable. It’s not random that more and more stalking apps keep popping up.

Lifestyle & Entertainment:

Broad appeal and tons of format freedom make it a great space to test bold angles and USPs. Just keep an eye open for emerging viral topics.

Religion & Faith:

Emotional formats and community-driven sharing continue to scale naturally. In the last 12 months, we covered over 9 Bible Apps, and there’s no sign it’s stopping here.

Finance and Investments

Demand keeps climbing, as most players in the market strugle with weak UI and low trust. Financial education, young investors and “money-maxxing” content isn’t going anywhere, making this niche a solid opportunity for the year ahead.

New App Opportunities for 2026

A few categories are quietly heating up, and if you’re building something new in 2026, these niches are worth considering.

The Alarm/routine management space is wide open: One old ASO-heavy app is doing $500K+ MRR, and a single alarm-related video recently crossed 23M+ views, proving clearly that demand is outpacing innovation.

The SleepMaxxing trend is another sleeper hit (literally). TikTok is full of routines and “healthmaxxing” content, yet there isn’t a single dedicated SleepMaxxing app on the App Store. With examples like Taller scaling to $60K MRR, this niche has strong upside.

We’re also seeing early momentum in Apple Watch apps. Simple UGC is pushing apps like Pulsebuddy AI and StressWatch to breakout numbers. The space is under-served and still early.

ADHD-friendly, simplified productivity tools are also gaining traction fast. TikTok users gravitate toward “one task at a time” formats, making the Single-Task method a real opportunity for builders.

If you’re looking for your next app idea, these categories offer strong signals and clear gaps that you can (and should) explore.

Data Protection and AI Rules

Make no mistake, regulation will tighten. The EU’s AI Act and ongoing GDPR enforcement efforts mean companies using AI-driven content or personal data at scale must prepare for stricter obligations, transparency, and provenance requirements.

Several states (like California, Virginia, Colorado, and Connecticut) have already rolled out stricter data-protection rules that directly affect how apps collect, store, and use user data.

Add to that theFTC’s growing scrutiny of deceptive UX, dark patterns, and AI-driven personalization, and it’s clear that U.S. enforcement is becoming more aggressive, especially for apps handling sensitive categories like health, finance, or minors.

On the AI side, the U.S. continues moving toward transparency and accountability guidelines, focusing on labeling AI-generated content, preventing data misuse, and tightening controls around biometric and facial-recognition data. It’s not EU-level strict yet, but the direction is clear: less “move fast and break things,” more “prove your systems are safe.”

Our advice: treat data protection as product design. Consent flows, creator release forms, provenance labels for AI content, and conservative defaults on biometric or face-based uses will reduce legal risk and platform friction.

SGE Action Playbooks

To make the most of all the information and insights in this report, we’ve bundled our highest-performing systems into a set of practical playbooks, the same ones fast-growing consumer apps use to plan, test, and scale their organic loops.

You’ll get a full 30-day TikTok content planner to structure your daily posting rhythm, plus a step-by-step TikTok execution guide that breaks down formats, pacing, and watch-time triggers.

Or, if you’re building a growth engine from scratch, the TikTok marketing funnel framework shows how to guide users from first scroll to install using simple, repeatable touchpoints.

We’ve also included our hook data sets, the proven patterns, openings, and emotional angles that kept showing up across the highest-performing videos, along with plug-and-play format guides for POVs, testimonials, story-driven UGC, and slideshow virality. Find them all here. Everything is built for speed: pick a playbook, plug it into your workflow, and start shipping content that’s already aligned with what works.

Ending Notes

2025 proved that organic growth is based on systems, consistency, and creators who understand how people actually behave on TikTok.

As we head into 2026, the playbooks are clearer than ever: pay attention to what others are doing in your space (and beyond), ship and test content daily, respect user trust, and lean into formats that spark real emotion.

If you apply what’s inside this report, you’ll be building with the same strategies today’s top consumer apps use to scale from “unknown” to solid revenue.

Let’s make 2026 your breakout year.

How We Collected the Data

To put this report together, we dug into 100+ consumer apps and reviewed thousands of short-form videos and slideshows. All the accounts tracking, content performance, and video analytics were done through Shortimize.

We focused on apps that are building organic reach through TikTok.

We also used our own in-house tools and smart AI systems to run the calculations, spot patterns, and make predictions.

About Social Growth Engineers

Social Growth Engineers helps consumer apps grow smarter and faster.

We break down what actually works across short-form platforms from viral formats and strategies to retention-driven storytelling and data-backed playbooks.

Our library is packed with deep dives, growth frameworks, UGC examples, ambassador breakdowns, and real numbers pulled from the top-performing apps in the industry.

If you want more insights, templates, and weekly breakdowns of the strategies shaping consumer app growth, explore our full resource hub here: socialgrowthengineers.com. And for daily insights, case studies, and bite-sized lessons, subscribe to our newsletter and follow us on X and LinkedIn.

Leave a Reply